UK – April 2025 – Author: Dean Wetton Advisory

What does Value for Members (VFM) mean?

Value for Members (VFM) refers to the overall value that Defined Contribution pension scheme members receive from their investments, considering costs, returns and service levels. VFM assessments are regulatory requirements that ensure members of pension schemes receive fair value for their investments.

There are two types of assessments: standard and enhanced. Schemes with assets under £100 million that have been operating for at least three years must carry out a more detailed enhanced VFM assessment at every scheme year-end after 31 December 2021.

Regulatory Compliance and Improvement

Trustees and Scheme Administrators often approach VFM assessments primarily as a regulatory requirement. DWA understands this need and can help you comply with regulatory standards. But we also recognise the opportunity these assessments provide to continuously improve a scheme’s offerings to members, allowing providers to demonstrate their commitment to delivering value to their members.

Enhanced Decision-Making

VFM assessments empower trustees and decision-makers with valuable insights into the scheme’s performance, enabling informed decisions that enhance the scheme’s value proposition and benefit its members.

Importance of VFM

- Ensuring Members are Being Cared For: VFM assessments ensure members receive fair value for their investments, safeguarding their financial interests.

- Encouraging Consolidation and Improving Efficiency: By evaluating and comparing schemes, VFM assessments promote consolidation and drive improvements in efficiency, leading to better outcomes for members.

Core Components of VFM Assessments

The assessments are broken down into three key areas:

Costs

Assessing the costs associated with a pension scheme is a crucial component of VFM evaluations. This includes administration fees, investment management fees and other charges that impact members’ returns.

Performance

Evaluating the investment returns is essential to determine the scheme’s performance. This involves analysing historical returns, risk-adjusted returns and comparing them with benchmarks and peers.

Service Levels

Service levels play a significant role in member satisfaction. VFM assessments consider the quality of services provided, including member communications, accessibility and overall member experience.

In addition, enhanced VFM assessments require schemes to obtain indicative terms from other providers for comparison. This ensures that members receive competitive value and have access to alternative options.

Challenges in Evaluating VFM

Short-Term vs. Long-Term Performance

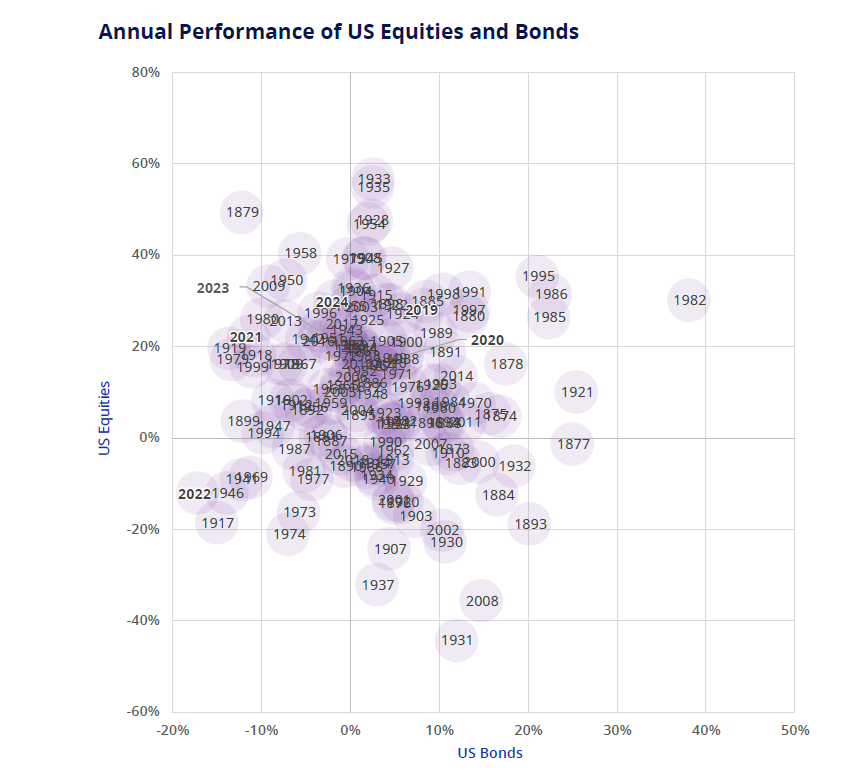

Evaluating VFM can be challenging due to varying market conditions. Recent history has seen significant variance in market conditions, with 2022 being one of the worst financial years in history (as demonstrated by the chart below showing the annualised performance for US Equities and Bonds going back to 1871). The pandemic also caused significant upset in the markets. However, outside of these events, we have seen unprecedented growth in markets with booming equities, particularly large US tech stocks. As schemes exist for longer periods, long-term performance data becomes available, allowing for a comprehensive analysis of full market cycles.

Source: Shiller Data, St. Louis Federal Reserve, DWA

Cost vs. Value

While costs are a defined metric, they do not always convey the full picture of value. There is a risk of over-focusing on costs without considering the broader value proposition. Balancing cost and value are crucial to providing fair assessments.

Personalised vs. Efficient Service

Employer schemes may offer personalised services to specific memberships but larger schemes often benefit from greater efficiency and access to a wider range of asset classes as well as investment opportunities.

How DWA Enhances Your VFM Assessments

At DWA, we offer comprehensive assessments to help you meet your Value for Members requirements and compare your scheme against other market options. We use several tools to assess the investment governance element of Value for Member, including:

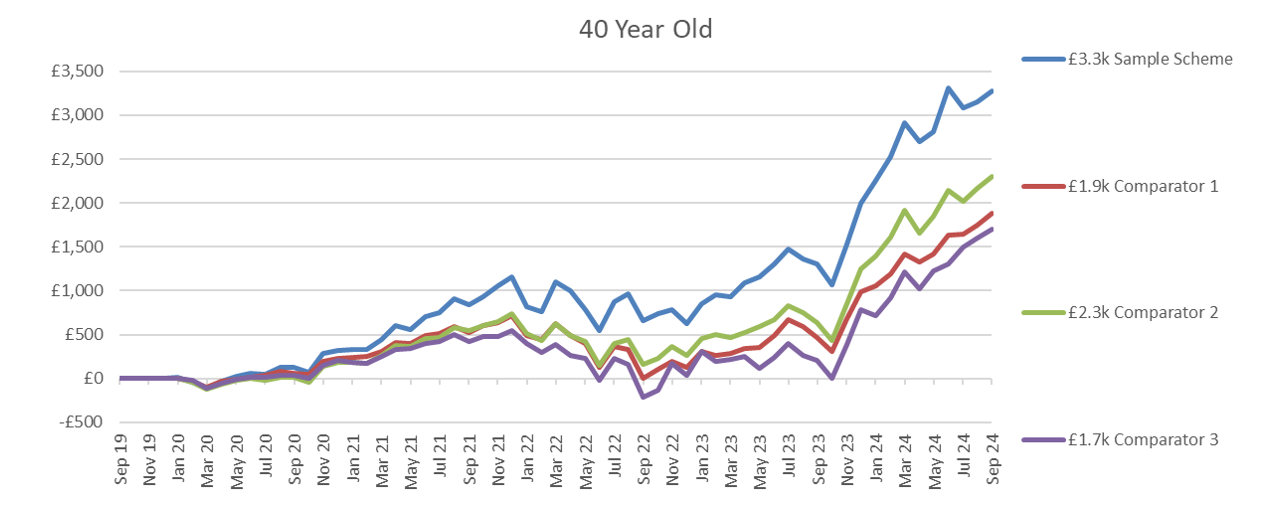

Historic Value Add and Value-Add Metrics

DWA evaluates how much members would be better off by being invested in different schemes or master trusts. This includes tracking the amount of money in a typical member’s pot over time and what they and their employer have paid in. However, historic returns are not guarantees of future returns.

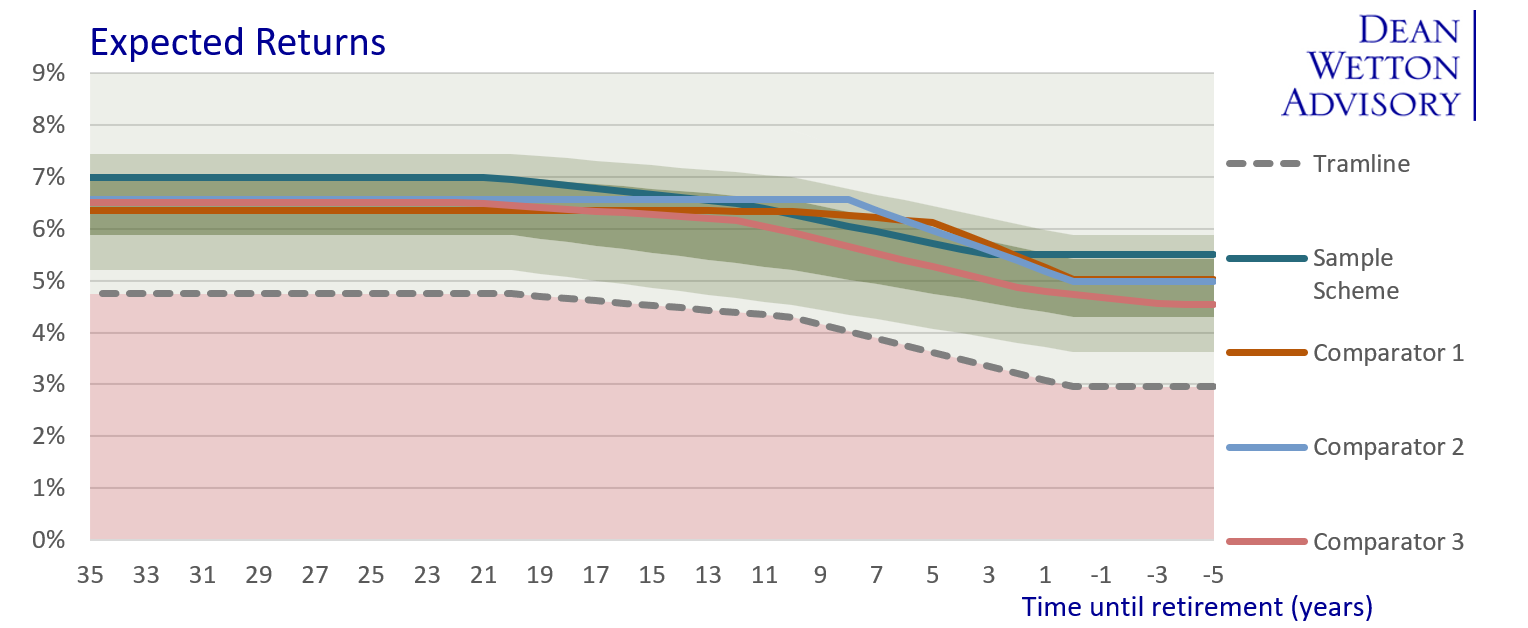

Fairway Model

DWA uses a fairway model to assess the investment strategy and illustrate the Scheme’s strategy and comparators. Each model takes a different risk or return metric and plots the glide path for each age cohort. The x-axis measures years until retirement, and the y-axis measures a single risk or return metric. Charts are divided into red and green areas, with green indicating appropriate default strategies and red areas requiring further investigation.

Metrics considered include:

- Expected Return: DWA allocates a long term expected return to each asset class. These expected returns are reviewed at least three times a year. By looking at its underlying asset classes, DWA can assign an expected return to a strategy across its glidepath.

- Maximum Drawdown: Measures the largest peak-to-trough fall, providing insight into worst-case scenarios.

- Standard Deviation: Measures month-to-month volatility, aiding in understanding investment behaviour.

- Risk Relative to Annuity Prices: Evaluates the ability to purchase an annuity and serves as a proxy for retirement income.

Why Choose DWA?

DWA offers comprehensive VFM assessments that goes beyond regulatory compliance. With DWA’s expertise, you can quickly identify areas where your scheme is delivering value for members and where improvements are needed. We provide detailed comparisons with other market options to ensure you achieve the best results.

Focusing on maximising value, minimising risk and ensuring member satisfaction, DWA is your trusted partner in delivering exceptional VFM assessments.

For more information, please contact us at +44 (0) 20 7947 9999 or info@deanwettonadvisory.com